The Future of Finance: How RPA is Shaping the Next Generation of Banking Sector

The way we bank is undergoing a dramatic transformation. Gone are the days of long queues and tedious paperwork. Today, we can manage our finances with a few clicks on our smartphones or a quick voice command. This revolution in the banking sector is being driven by a powerful force: Robotic Process Automation (RPA). RPA in banking has streamlined operations, enhanced customer experiences, and revolutionized traditional banking processes, paving the way for a more efficient and convenient banking experience.

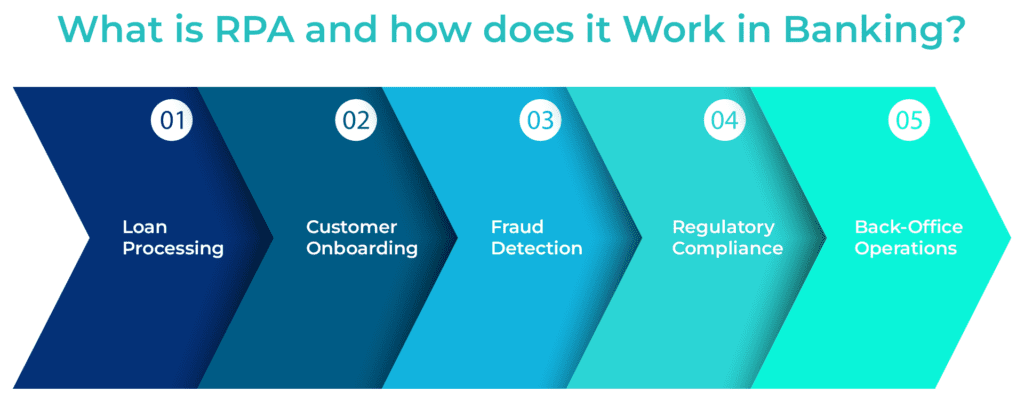

What is RPA and How Does it Work in Banking?

Imagine a tireless, digital assistant working behind the scenes, meticulously handling repetitive tasks in your bank. That’s essentially what Robotic Process Automation is. It’s software that mimics human actions by interacting with various computer applications just like we do. But unlike us, RPA bots can work 24/7 without errors, significantly boosting efficiency and accuracy.

In the banking sector, RPA is being deployed across a wide range of functions, including: Here are some key areas where RPA in banking is revolutionizing processes:

- Loan Processing: The loan application process can be a tedious journey for both the customer and the bank. RPA in banking can automate tasks like data verification, document collection, and creditworthiness checks, significantly reducing processing time and streamlining the experience for everyone.

- Customer Onboarding: Opening a new account often involves a flurry of paperwork. RPA in banking can automate data entry from ID verification to customer information, making onboarding faster and smoother, allowing customers to access their accounts quicker.

- Fraud Detection: Financial fraud is a constant concern. RPA in banking can continuously monitor transactions for suspicious activity, freeing up human analysts to focus on complex cases and preventing fraudulent transactions in real-time.

- Regulatory Compliance: The banking industry is heavily regulated. RPA in banking can automate tasks like report generation and data gathering for regulatory compliance, ensuring accuracy and reducing the administrative burden on banks.

- Back-Office Operations: Repetitive tasks like reconciliation, data entry, and report generation in the back-office can be automated through RPA in banking, freeing up employees to focus on more strategic tasks and customer service.

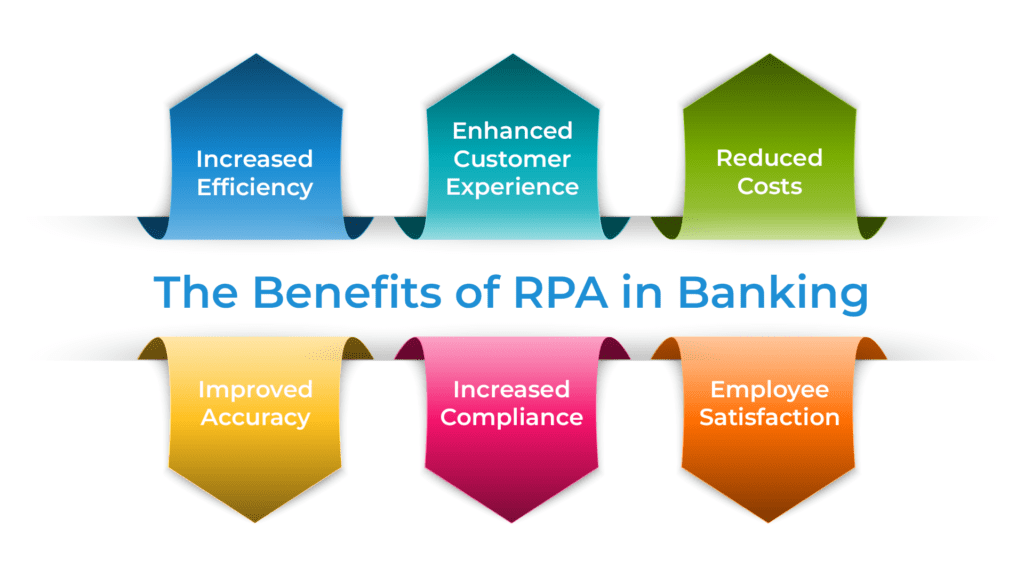

The Benefits of RPA in Banking

The adoption of Robotic Process Automation in banking offers a multitude of benefits for both banks and customers. Here are some key advantages:

- Increased Efficiency: Repetitive tasks are completed much faster and with fewer errors, leading to significant productivity gains.

- Enhanced Customer Experience: Faster account opening, loan processing, and improved response times to inquiries lead to a more positive customer experience.

- Reduced Costs: Automating tasks lowers operational costs associated with manual labor.

- Improved Accuracy: Robotic Process Automation eliminates human error from repetitive tasks, leading to a higher degree of accuracy.

- Increased Compliance: Automating compliance-related tasks ensures timely and accurate reporting, reducing the risk of regulatory fines.

- Employee Satisfaction: By freeing up employees from repetitive tasks, Robotic Process Automation allows them to focus on more value-added activities and enhances job satisfaction.

To know about RPA Service: Read Blog: Understanding RPA Services: A Beginner’s Guide to Automation.

Security Considerations with RPA Implementation

While Robotic Process Automation offers a plethora of benefits, security is a paramount concern, especially in the financial sector. Here are some key considerations:

- Data Security: Banks need to ensure that sensitive customer data is protected throughout the RPA process. Robust security protocols and access controls are crucial.

- Bot Monitoring: It’s essential to monitor the activity of RPA bots to ensure they are functioning correctly and haven’t been compromised by malware.

- Disaster Recovery: Banks need to have a robust disaster recovery plan in place to ensure business continuity in case of system failures related to RPA.

The Future of Banking with RPA

RPA is not just a passing trend; it’s a fundamental shift in how banks operate. As RPA technology continues to evolve, we can expect even more sophisticated applications in the banking sector. Here’s a glimpse into what the future holds:

- Cognitive RPA: Integrating Artificial Intelligence (AI) with RPA will enable bots to handle more complex tasks requiring judgment and decision-making.

- Enhanced Customer Experience: RPA-powered chatbots will become more intelligent and personalized, providing a seamless and interactive customer experience.

- Fraud Detection and Prevention: RPA can be used to analyze vast amounts of data in real-time, identifying and preventing fraudulent activities.

- Hyper Automation: Combining RPA with other automation technologies like AI and Machine Learning (ML) will create a self-learning and self-healing automation ecosystem in banks.

You may like also: Understanding Payroll Automation: How RPA Smooths Payroll Processes.

Conclusion

RPA is revolutionizing the banking sector by streamlining processes, enhancing efficiency, and improving customer experience. As this technology continues to develop, we can expect even more exciting advancements that will usher in a new era of intelligent and customer-centric banking.

By embracing RPA, banks can ensure they are well-positioned to navigate the ever-changing financial landscape and stay ahead of the competition. This shift towards automation will not only benefit banks but also empower customers with faster, more secure, and personalized banking experiences.